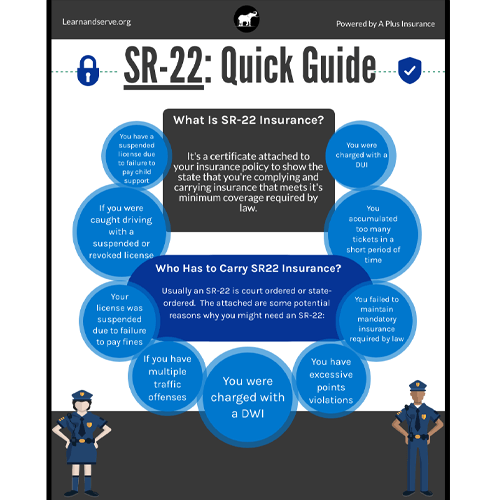

An SR-22 is not an actual "kind" of insurance coverage, but a type filed with your state. This form serves as evidence your car insurance coverage plan meets the minimal obligation coverage called for by state legislation.

Do I need an SR-22/ FR-44? Not everybody requires an SR-22/ FR-44. Rules vary from one state to another. Usually, it is needed by the court or mandated by the state just for sure driving-related infractions. : DUI convictions Negligent driving Mishaps created by without insurance vehicle drivers If you require an SR-22/ FR-44, the courts or your state Electric motor Vehicle Department will notify you.

Current Customers can contact our Consumer Solution Division at ( 877) 206-0215. We will certainly evaluate the insurance coverages on your policy and also start the procedure of filing the certificate on your behalf. Exists a fee related to an SR-22/ FR-44? A lot of states charge a flat charge, however others call for an additional charge. This is an one-time cost you must pay when we file the SR-22/ FR-44.

A filing charge is billed for each and every specific SR-22/ FR-44 we file. If your spouse is on your plan and both of you need an SR-22/ FR-44, after that the filing charge will be billed two times. Please note: The fee is not included in the price quote because the declaring cost can differ.

The length of time is the SR-22/ FR-44 valid? Your SR-22/ FR-44 must stand as long as your insurance policy is energetic. If your insurance policy is canceled while you're still required to carry an SR-22/ FR-44, we are called for to inform the proper state authorities. If you don't keep constant insurance coverage you could lose your driving privileges - car insurance.

An insurance card or plan will not be approved in area of an SR-22. What Are The Many Typical Reasons Vehicle Drivers Obtain An SR-22? Vehicle drivers request an SR-22 certification for various reasons; nonetheless, most typically it's to help make sure the Department of Electric Motor Autos that you have the basic insurance policy protection as needed by regulation.

Not known Details About Houston Sr-22 Insurance

If you have actually been requested to submit an SR-22 because you really did not have insurance policy at the time you'll first have to obtain state minimum protection too which will be charged independently from the SR-22 declaring. If you currently have car insurance and also the state has asked for an SR-22 declaring after that you need to call them for a cost quote - no-fault insurance.

Will an SR-22 Insurance Certificate Raise My Auto Insurance Policy Prices? It is not likely that having an SR-22 certificate filed with the state would increase your insurance coverage rates.

(Mon-Fri, 8am 5pm PST) for a of your SR22 Texas, or submit this kind: Find out about. bureau of motor vehicles. What it is, that requires it, SR22 Texas Insurance estimates, business, comparisons, what it covers, how it functions, uniqueness for Texas state, just how to obtain SR22 automobile insurance, revival and/or expiry and a lot a lot more.

While this might be real, there are numerous as to why an individual could be expected to buy an SR22. SR-22 a sort of vehicle coverage. ignition interlock. In truth, it is simply a paper asked for via the (Division of Motor Automobiles) that has to be loaded out and certified by utilizing a qualified automobile insurer.

It is an official certification by your insurance coverage business that you have maintained constant car insurance coverage for the thirty-day period it is actually submitted. In case your certificate is put on hold due to so many traffic factors, you might be asked for to file an SR-22 for 3 years - underinsured.

In the event your license is actually put on hold as a result of a DUI, you may have to furthermore file an SR22 to acquire your license back once more. Without SR22 insurance policy protection, you really your present permit and. The SR-22 Kind for the SR22 Insurance Coverage Texas, SR22 car insurance policy protection is considered "" insurance policy coverage - coverage.

Getting The Illinois Sr-22 Certificate, High Risk Driver Insurance To Work

Because of the reality that SR 22 regulations and procedures between states, vehicle operators are encouraged to choose an insurance coverage business that recognizes their demands as well as may well of SR-22 declaring. Obtaining a could lead to and furthermore your vehicle driver's permit retraction if you do not understand the costs and. sr22.

Great deals of people even car insurance protection plan contrasted to their normal plans,,,,,, as well as are the most effective insurance policy agencies right currently. You can connect with them by filling out the blue box on this website to get the least expensive premium prices for your SR-22 insurance coverage in Texas. insurance.

It truly depends on which state you stay in as well as the number of violations you have incurred. That is why the most effective action you can take is to request a cost quote online. Considering that SR22 insurance protection is a type of insurance policy that you will require to acquire if you have substantial traffic transgressions, having the insurance policy strategy shows you are a higher danger car chauffeur, consequently, it can trigger a raised SR22 insurance coverage expense. department of motor vehicles.

Each cars and truck insurance policy protection firm will offer a distinct rate to have an SR-22 kind, however, ensure to know exactly why they can be unique. The SR22 insurance estimates from one certain agency compared to an additional could be around 50% higher. Some firms might have greater SR22 rates or there could be accessory advantages with their protection over the real even more inexpensive insurance coverage plan.

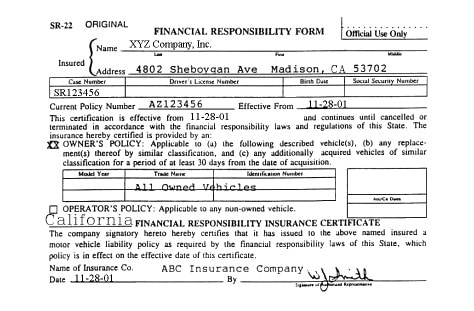

The SR22 Texas qualification is available in 3 kinds: Operator's Certification This insurance coverage covers a chauffeur throughout the lorry's procedure involving any non-owned automobile. Whenever the operator does not possess an automobile, a financial commitment requirement may likely exist with the Driver's Certification. Proprietor's Certification This particular insurance plan covers an auto had by the vehicle chauffeur.

Operator-Owner Certificate This certification covers all vehicles owned or non-owned by the vehicle driver. An SR22 may be acquired by connecting with a great service provider that is certified to produce SR-22 insurance coverage for Texas. As quickly as settlement is made to the service provider, a broker will likely send a new request when it come to SR-22 paperwork for the headquarters.

Fascination About Future Financial Responsibility - Adot

This process may take about thirty days. Following approval, the person will certainly receive a duplicate of the SR22 form from an insurance carrier as well as additionally a letter from the State's Secretary. As quickly as the insurance coverage is authorized, it needs to be maintained for a duration of three years.

Specifications of When you carry an SR22 in one state but transfer to a various state, you have to accomplish the SR22 filing requirement for your prior state, although you no more stay there. Furthermore, your insurance policy coverage for the new state has to have responsibility limitations which meet the minimums needed by law in your preceding state.

While you may have a California plan, you'll have the ability to file an SR22 Texas up until the probationary period ends (sr22 coverage). Instance B: from a different State to Texas, Ought to you be living in California and also transfer to Texas, you do not require to file an SR-22 with Texas (preventing any certain problems), as the state of Texas will not need you to bring an SR-22 declaring according to your driving background in California.

, concerning general non-owner car insurance policy and also various other non proprietors insurance. car insurance. SR22 Texas auto insurance policy protection is equivalent to typical vehicle insurance policy protection in numerous ways. The key distinction is the reality that in comparison to typical lorry insurance, the service provider that gives you an SR22 Bond will be needed by the federal government to inform the Public Safety Texas Division in instance your policy ends.

Obviously, you can acquire much extra protection with an SR22 cars and truck insurance policy if you actually wish to do so. Because you may be obtaining SR22 automobile insurance coverage in the very first area (given that you may have done something to create the cancellation of your motorist's permit), you'll possibly be put in a, as well as will consequently have to pay greater than you normally would to proceed your protection.

You'll locate a number of offices throughout the state where you can file your SR22 kind personally, consisting of one in,, as well as. These are generally a few of the you'll need to disclose on the paper: Your motorist's permit number, Your Social Safety Number, Your birth day, Particular car information, like your auto's Vehicle Identification Number (VIN)The begin as well as end days of your auto insurance coverage plan, When you acquire an SR22 Texas insurance coverage, you'll have really little time to determine whether it is time for you to recover the insurance policy protection policy. auto insurance.

The Ultimate Guide To Illinois Sr-22 Insurance

A great deal of individuals will opt for their current insurance policy business however you can conserve thousands of bucks with alternate SR22 insurance coverage companies. Some companies have various rates for motorists with a DWI or various other major infractions which could conserve you a bunch of money. Consider downgrading to a slower or older auto for the whole filing duration.

A driver that has actually maintained protection for time and has been exercising very may have their insurance coverage business run an additional motor automobile record during renewal time to see if any of their convictions have actually handed over. This might decrease premiums throughout time. Identify if you are able to or accident for older autos.

Sometimes insurance coverage firms lower insurance policy expenses as sentences diminish. motor vehicle safety. You need to make sure you aren't paying a lot more for an insurance plan than is required, also making use of a declaring in your policy. This might not make much sense however in case you have a motorcycle, it will certainly save you a good deal of cash.

Your current business might not be recommended of the citation that triggered the required SR22 so your insurance policy protection costs should not change. By having liability insurance coverage on a motorbike with the SR22, it'll meet all the state requirements and potentially save you lots of cash money. As soon as the reinstatement specifications have actually currently been satisfied, you can quit the bike plan or relocate it to your original insurance provider, We provide SR22 insurance coverage certificates for all cities of Texas, consisting of: Houston, San Antonio, Austin, Dallas, El Paso, Ft Well Worth, Corpus Christi, Arlington, Laredo, Plano, Garland, Lubbock, Amarillo, Irving, Mc, Kinney, Grand Prairie, Brownsville, Frisco, Killeen, Mesquite, Mc, Allen, Denton, Carrollton, Waco, Abilene, Round Rock, Richardson, Pearland, Sugar Land, Odessa, The Woodlands (CDP), Lewisville, University Station, Tyler, Organization City, Allen, Wichita Falls, Edinburg, San Angelo, Bryan, Conroe, New Braunfels, Goal, Pharr, Longview, Baytown, Blossom Pile, Holy Place, Cedar Park, Missouri City, Atascocita (CDP), North Richland Hills, Georgetown, Victoria, Mansfield, Harlingen, Rowlett, San Marcos, Pflugerville, Euless, Springtime (CDP), Grapevine, Port Arthur, Galveston, De, Soto and numerous others.

If you recognize the requirements, you can obtain the correct coverage,, and come to be a! Drive Again Quickly Just With Our Affordable SR22 Insurance Texas! (Mon-Fri, 8am 5pm PST) for a or complete this form:.

Texas Type SR22 Insurance coverage is necessary for a period of 2 (2) years from the day of sentence (credit score). An SR-22 is a 'certification of insurance coverage' that shows the Texas Department of Public Safety evidence of insurance coverage for the future, as called for by legislation. It is motor automobile obligation insurance policy that requires the insurer to license coverage to Texas DPS, and also the insurance provider have to inform DPS anytime the plan is terminated, ended or lapses.

Some Ideas on What Is Sr22 Insurance & How Much Does It Cost? You Should Know

Texas Minimum Obligation Amounts: Current minimal liability protection quantities are $25,000 for physical injury to or fatality of one individual in one crash; $50,000 for physical injury to or death of 2 or more individuals in one crash; $25,000 for damages to or devastation of building of others in one mishap. division of motor vehicles.